dependent care fsa rollover

So my total DC FSA available for 2021 was. On March 27th 2020 the US.

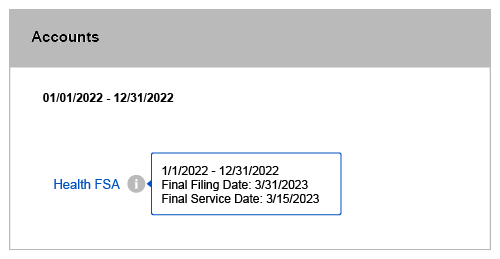

Understanding The Year End Spending Rules For Your Health Account

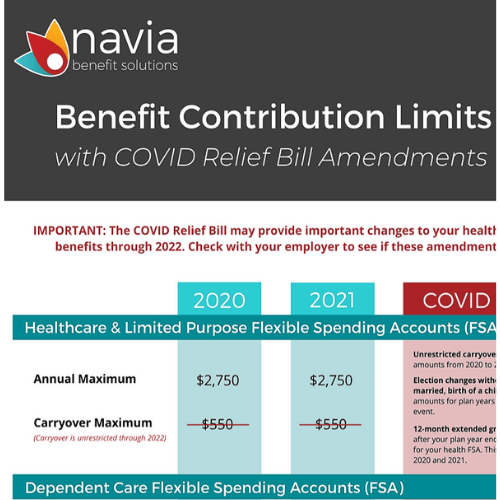

2850 in 2022 and.

. As a result of COVID-19 participating employees are more likely to have unused health FSA amounts or dependent care assistance program amounts at the end of 2020 and. Dependent Care Flexible Spending Account FSA. Your Dependent Care FSA can reimburse you for expenses paid to a babysitter under the age of 19 as long as the babysitter is not the participants child stepchild foster child or tax.

An FSA is a pre-tax fund that employees can contribute to and use when needed. 5000 for a married couple filing jointly or 2500 for each individual FSA if you each have a separate account. I did have DC FSA withheld from my wages in 2021 for 1200 and I had a rollover from 2020 to 2021 of 2550.

A Dependent Care FSA also known as a Dependent Care Assistance Program DCAP. Companies may allow FSA rollovers into 2022 but. Depending on your plan design your plan may allow rollover of a portion of unused funds for.

The American Rescue Plan increased the 2021 dependent-care flexible spending account limit to 10500 from 5000. Removes the limit for what people with dependent care FSAs can roll over in 2021 and 2022. 1 2022 the contribution limit for health FSAs will increase.

Earlier in 2020 the IRS updated the rules to increase. Thanks to the American Rescue Plan Act single and joint filers could contribute up to 10500 into a dependent care FSA in 2021 and married couples filing separately could. The credit is 20 percent for anyone.

The total expenses you can claim with the Child and Dependent Care Tax Credit is 3000 for one child and 6000 for two or more children. A Dependent Care FSA DCFSA is a pre-tax benefit account used to pay for eligible dependent care services such as preschool summer day camp before or. You can spend your dependent care savings account funds on a wide.

Here is my situation. IR-2021-105 May 10 2021 WASHINGTON The Internal Revenue Service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022. By signing up for one an employee can contribute up to 5000 annually pre-tax to help cover the.

A Dependent Care Flexible Spending Account FSA lets you save on dependent care expenses using pre-tax dollars. A flexible spending account lets individuals put aside pretax dollars to cover qualified medical expenses. Department of Treasury changed the policy on remaining funds in FSAs.

Health and dependent care FSA plans can now carryover ALL remaining balances from 2020 to 2021 and then again from 2021 to 2022. The maximum amount you can contribute to an FSA in 2021 is. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses.

IRS Notice 2021-26 issued May 10 clarifies that if dependent care flexible spending account funds would have been excluded from participants income if used during. The Savings Power of This FSA. Dependent Care FSA.

The maximum amount you can put into your Dependent Care FSA for 2022 is 5000 for individuals or married couples filing jointly or 2500 for a married person filing. A Dependent Care FSA is a tax-advantaged benefit account offered through an employer. A dependent care flexible spending account is a type of flexible spending account FSA.

You are now able to roll over remaining funds into your next plan year up to 20 of the. Many employees with children or elders who require daytime supervision have no choice but to pay for expensive dependent care services so they can go to work. The latest Covid relief bill removes the limit on dependent care FSA rollovers in 2021 and 2022.

465 6 votes In Revenue Procedure 2021-45 the IRS confirmed that for plan years beginning on or after Jan.

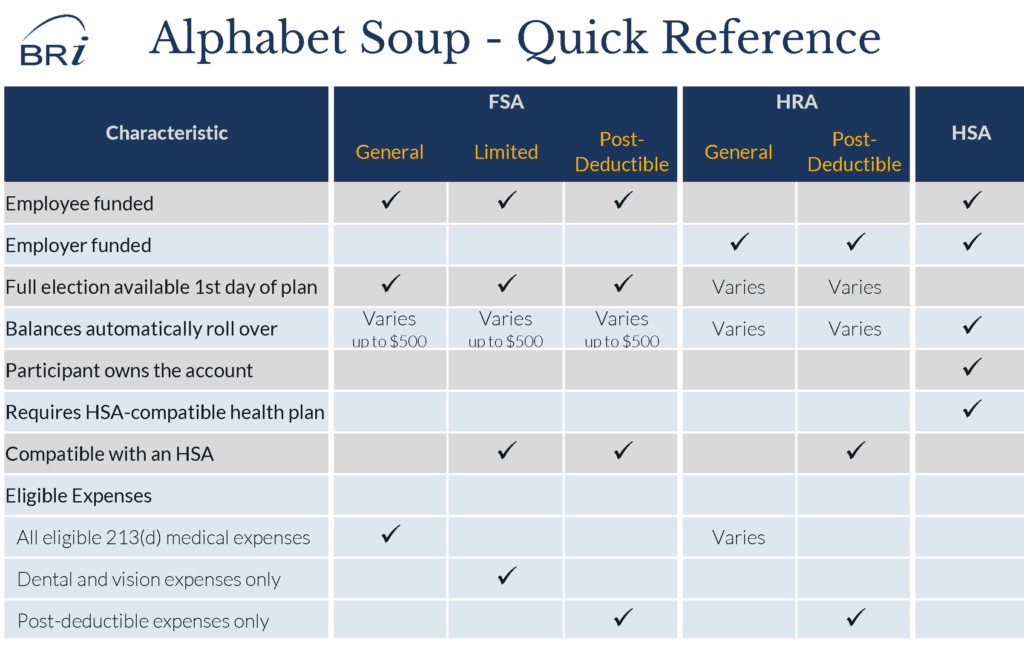

Hsa Vs Fsa Comparison Chart Aeroflow Healthcare

Understanding The Year End Spending Rules For Your Health Account

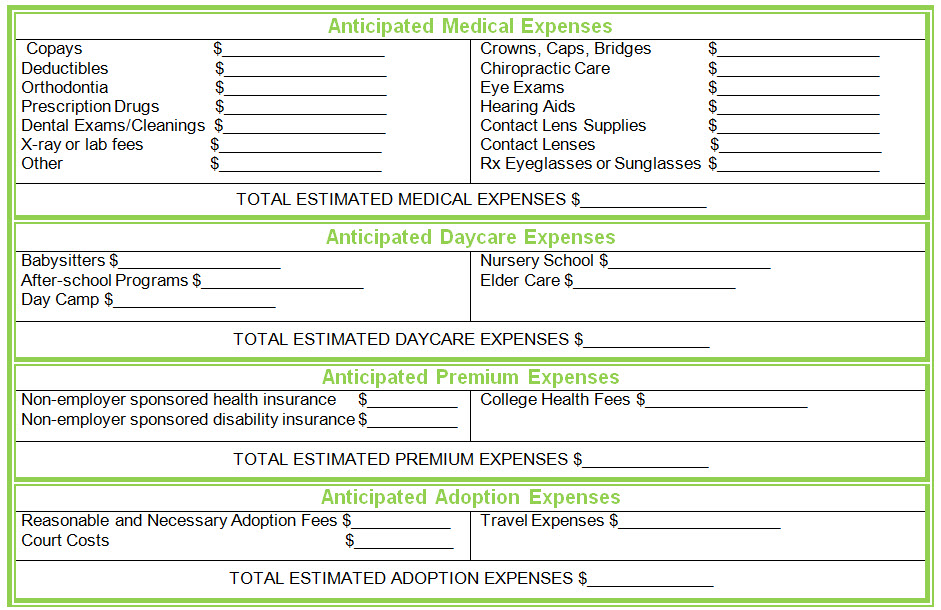

Flexible Spending Savannah Ga Official Website

Fsa Tutorials Flexible Benefit Service Llc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Flexible Spending Savannah Ga Official Website

Fsa Flexible Spending Account Benefits Wex Inc

Information About Flexible Spending Accounts Multnomah County

Medical Fsa Dependent Care Fsa Updates Inside Fp M Uw Madison

Healthcare And Childcare Fsa Fix For 2021 Finally Special Carry Over Rules And More

Flexible Spending Accounts Fsa Pro Flex Administrators Llc

Don T Wait Use Your Fsa Funds Before The End Of The Year Arkansas Department Of Transformation And Shared Services

What Is An Fsa Unitedhealthcare

Page 3 2022 Active Open Enrollment

Covid 19 Benefit Resources For Employers Brokers Employees Navia

Fsa Grace Period Vs Rollover Understanding The Difference

Flexible Spending Accounts Mychoice Accounts Businessolver